Bequests

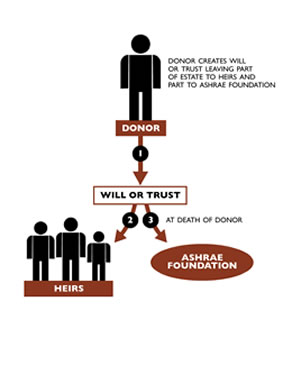

The most common planned giving arrangement for the benefit of ASHRAE Foundation is the will bequest. Charitable gifts made by will are 100% tax deductible. As with current gifts, bequests may be designated either as unrestricted - providing the most flexibility - or restricted; that is, designated for a specific purpose.

If you wish to include an unrestricted bequest to ASHRAE Foundation in your will, the following language is suggested:

Unrestricted Bequest to ASHRAE Foundation

"I give, devise, and bequeath to the ASHRAE Foundation, Atlanta, GA, ______ percent of all the rest, residue, and remainder of my estate (or _______ dollars, property, securities, etc. described below) wheresoever located to be used for the benefit of ASHRAE Foundation in such manner as the ASHRAE Board of Trustees thereof may direct."

If you wish to provide scholarships for students in a field or school, here is suggested language for three options:

Scholarships Based on Financial Need

Scholarships Based on Academic Merit

Scholarships With Neither Financial Need nor Academic Merit Specified

Benefits

* Distribution of estate as intended by donor.

* Avoidance of estate and inheritance taxes.