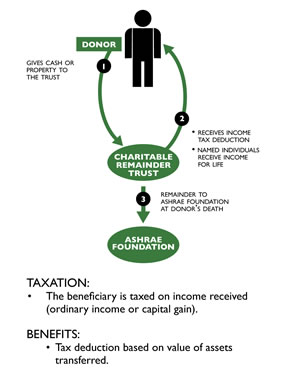

Charitable Remainder Trust

Charitable Remainder Trust

This type of trust is established when you irrevocably transfer money or securities to a trustee who invests the assets to pay an annual lifetime income to you or others chosen by you. At the end of the income beneficiaries' lives, or the term of years, the remaining trust assets are distributed to ASHRAE Foundation. When properly established, these trusts provide federal gift and estate tax savings.

Annuity trusts provide current tax benefits along with the security of a fixed, lifetime income. The agreed upon payments remain unchanged regardless of how the investments perform. ASHRAE Foundation can act as trustee. The minimum amount needed to establish a charitable remainder annuity trust is $50,000.

To calculate the benefits of your gift click below:

Taxation: The beneficiary is taxed on income received (ordinary income or capital gain).

Benefits: Tax deduction based on value of assets transferred.